Daily Market Analysis and Forex News

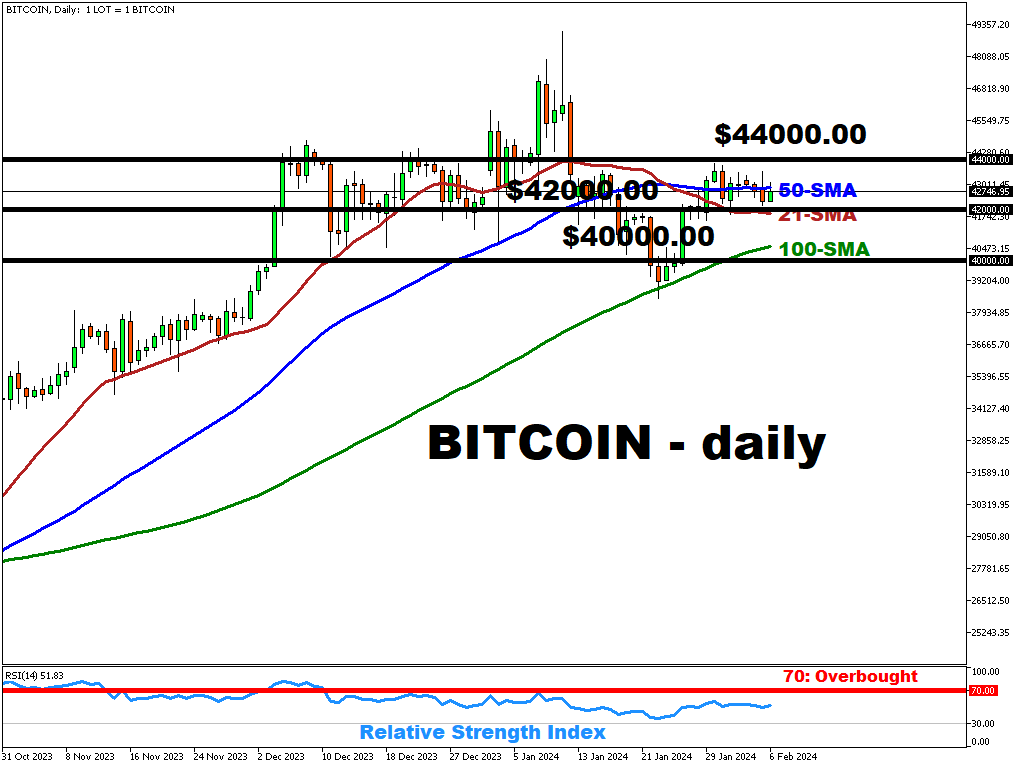

Bitcoin consolidates near 50-period SMA

Bitcoin is hovering near the 50-period SMA (~42883) amid the higher-than-expected (53.4 vs 52 expected) US’ services PMI reading.

A rise in the PMI reading may reduce the chances of the much-anticipated rates cuts in the near future.

Higher for longer interest rates may affect the investors’ appetite for riskier assets such as bitcoin.

Currently, the market is pricing in a 16.5% chance of a rate cut in March (64.0% - 1 month ago).

On the ETF side …

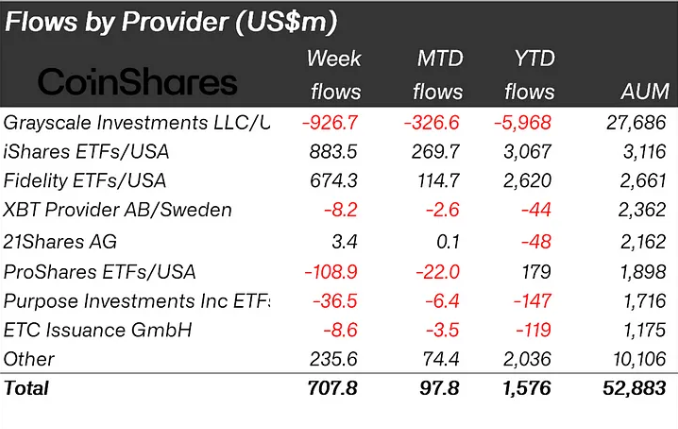

Despite concerns over the recent wave of withdrawals, the newly launched spot BTC ETFs have managed to attract a total of $7.7 billion in inflows, offsetting $6 billion in outflows.

Recently released data also underscores a slowdown in the outflow momentum over the past few weeks.

From a technical perspective …

- BTC trading above 21 and 100-period SMAs underscores the potential for an upward trend

- Current RSI position (~51.83) highlights the market’s current state of uncertainty as investors await further catalysts (e.g. macroeconomic readings, ETF data, SEC activity)

- Key resistance is positioned at 50-period SMA (~42879). A break above this level could propel the price higher towards the $44000 round number

- An immediate support level is positioned at 21-period SMA (~41876). A break below it may pull bitcoin lower towards the 100-SMA (~40547), which is just above the psychologically important $40000 level

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.