Daily Market Analysis and Forex News

Nvidia climbed above $1000 postmarket on strong earnings

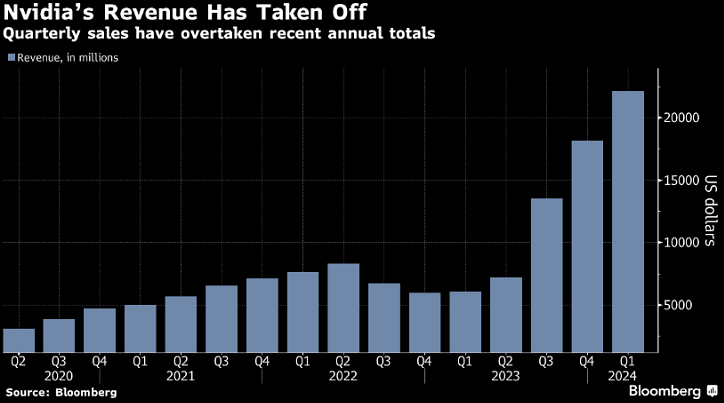

Nvidia climbed above $1000 postmarket after reporting its best-ever quarterly revenue and earnings results, showing 262% year-over-year revenue growth and 585% jump in earnings.

The company's data center division, centered around AI, is the largest source of revenue for the company ($22.6 billion - 427% YoY growth).

The company has also announced its plan to carry out a 10-for-1 stock split, which is scheduled to take place on June 7 this year.

This would reduce the share price from around $950 (as of yesterday's close) to $95 per share.

By making the stock more affordable to investors, Nvidia may appeal to a wider audience.

Despite very strong growth in recent quarters, the markets expect the company to continue to grow at a substantial rate.

According to consensus estimates, Nvidia's revenue is expected to reach a total of $117.1 billion by the end of this fiscal year.

From a technical perspective...

the company's stock is trading above its 21-, 50- and 100-period SMAs, underscoring a strong potential for both short- and long-term bullish trend.

The Relative Strength Index (RSI) is still in neutral territory (~60), signaling further upside potential (<30 - oversold; >70 - overbought).

On the downside, the ~917.88 level may provide immediate support, while on the upside, the all-time high (~973.75), followed by the $1000 psychologically important level, may be the primary resistance/target level for Invidia bulls.

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.