Daily Market Analysis and Forex News

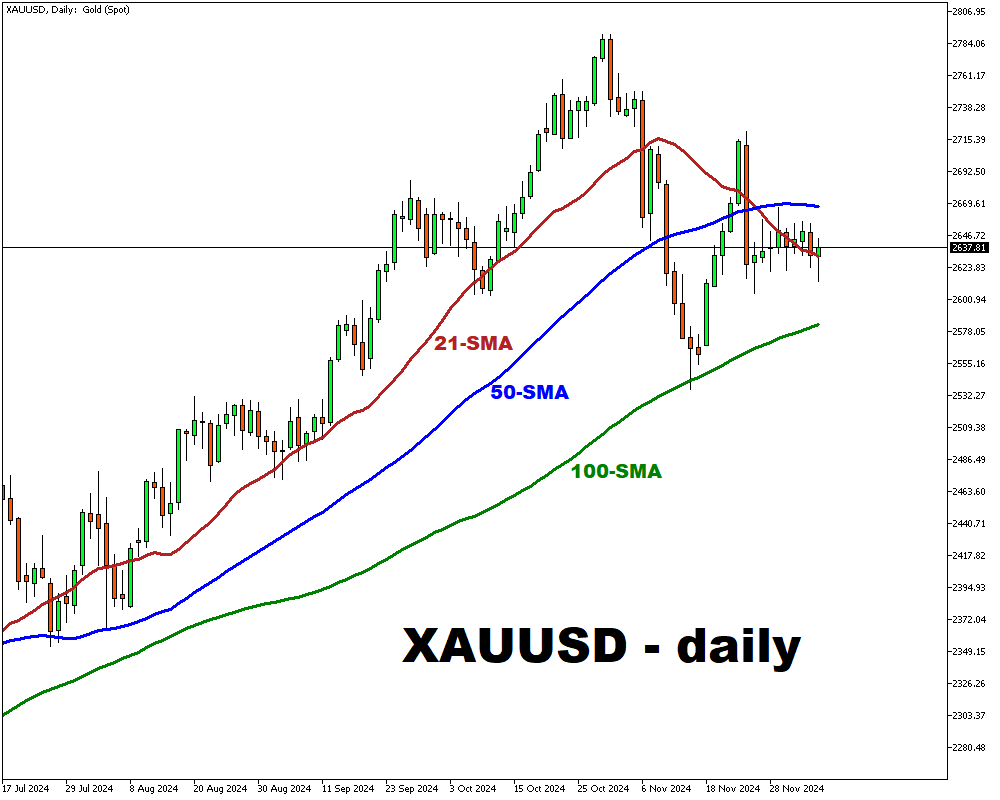

XAUUSD poised for 2nd straight weekly decline?

- Global Drivers: Conflicts and economic fears boosted demand

- China’s Role: Central bank, consumers led gold buying spree

- Fed Policy Impact: Rate cuts, labor data influence gold prices

- Potential trading range: 2,588.29-2,701.02 (73.4% probability), Bloomberg

Gold prices have been on a volatile but record-breaking ride in 2024, driven by a mix of global uncertainty and economic shifts.

Early Friday, gold prices fell to an eight-day low of $2,613 as markets await U.S. Nonfarm Payrolls (NFP) data.

Despite a modest recovery to $2,638, gold is still down 0.4% for the week, reflecting its second consecutive weekly decline.

According to Bloomberg, the 7-day trading range for XAUUSD may fall within 2,588.29-2,701.02 (73.4% probability).

Traditionally, gold rallies during times of geopolitical turmoil and economic uncertainty. This year, conflicts such as the turmoil in the Middle East have fueled demand.

However, a significant driver has been central banks, notably the People’s Bank of China, increasing gold reserves.

Chinese consumers also drove the rally, seeking gold as a hedge against domestic economic challenges.

The prospect of interest rate cuts by the U.S. Federal Reserve also influenced prices.

A weaker-than-expected NFP could support gold by reinforcing dovish policy.

Conversely, strong job growth could strengthen the U.S. dollar and weigh on non-yielding gold.

While the 2024's gold rush reflects traditional safe-haven appeal, it also underscores new global economic complexities that shaping the precious metal's role in uncertain times.

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.