Daily Market Analysis and Forex News

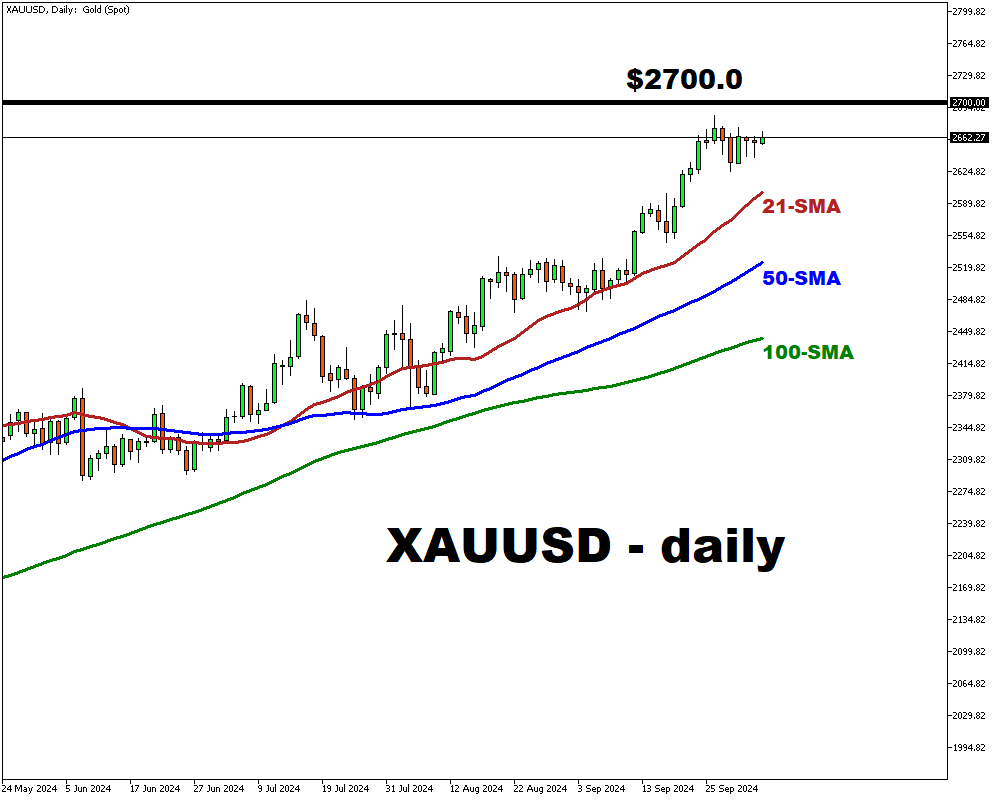

XAUUSD steady at $2,660 amid rising escalation

- Gold steady at $2,660 per ounce

- Geopolitical tensions heighten safe-haven demand

- Biden's remarks on Israel and Iran raise concerns

- Strong labor data tempers gold's upward momentum

- 67% chance of 25 bps rate cut in November

Gold remains steady at approximately $2,660 per ounce, sustaining its record levels as its status as a safe-haven asset was heightened by increasing geopolitical tensions.

Market participants are closely observing developments in the Middle East, particularly after US President Biden refrained from explicitly condemning the possibility of Israel targeting Iran during his remarks on Thursday.

In response, Tel Aviv has vowed to retaliate against Iran while intensifying its military activities in Beirut.

Simultaneously, robust labor market data released earlier this week has tempered gold's upward momentum, as it suggests a reduced need for the Federal Reserve to adopt a more accommodative monetary policy.

The ISM data indicated that US services activity grew at its fastest rate in over a year in September, further influencing market sentiment.

Currently, traders estimate about a 67% chance that the Federal Reserve will implement a modest 25 basis points rate cut in November.

Investors are keenly awaiting the release of September's NFP figures later today, which are expected to provide additional insights into the labor market and its potential impact on monetary policy decisions moving forward.

Готовы торговать реальными деньгами?

Открыть счётGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.