Daily Market Analysis and Forex News

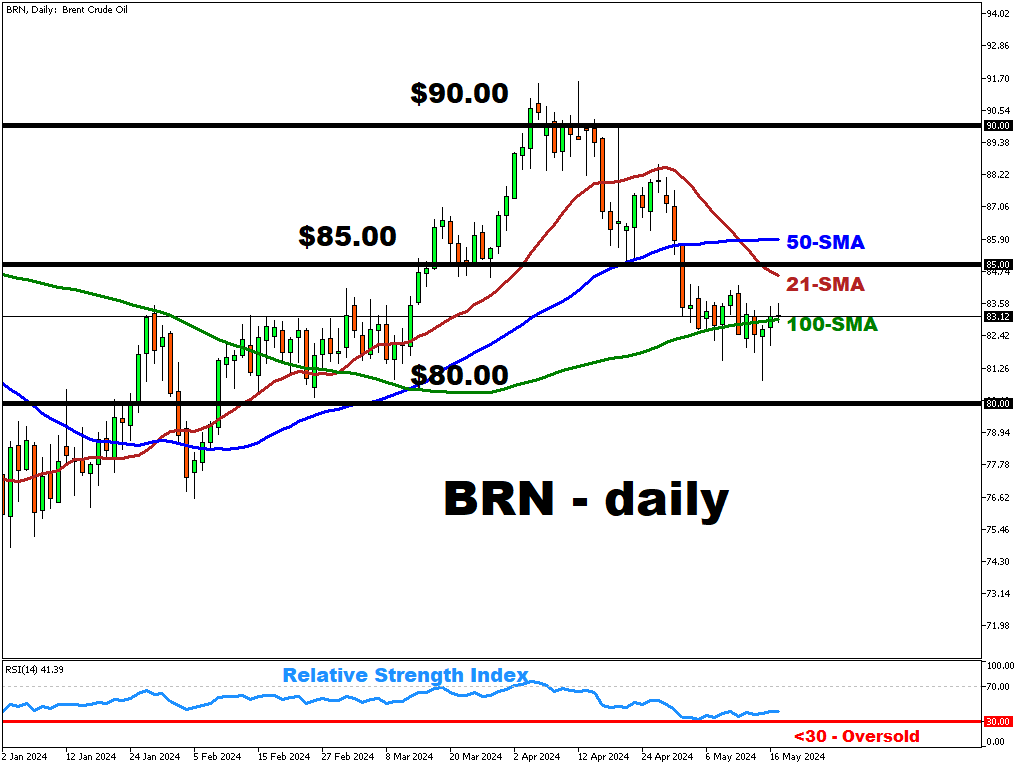

Oil bulls are fighting to stay above 100-period SMA at $83/bbl.

Oil bulls have managed to climb above the 100-period SMA on the back of the softer US CPI reading earlier this week as well as the higher-than-expected draw from US crude inventories.

- US API crude stockpiles fell by 3.1 million barrels last week (vs. -1.35 million barrels expected)

However, the risk of interest rates staying higher for longer and the IEA's recently cut oil demand forecast for 2024 could add to the pressure on Brent.

High borrowing costs could dampen economic growth and thus oil demand.

- This year, oil demand is expected to grow by 1.1 million bbl/day (-140K from the previous forecast)

- The markets are currently pricing in (with a >50% probability) that the Fed will not start lowering interest rates until September 2024

The IEA's global supply forecast has also been revised downward due to power outages in Brazil following severe flooding and logistical challenges in the United States.

- This year's supply is expected to increase by 580K bbl/day (vs. previously forecast 770K bbl/day)

- In the contract, OPEC kept its forecast from last month intact at 2.25M bbl/day

In order for Brent to potentially move back above $90/bbl, the markets may need to see deeper supply cuts implemented by OPEC+ and/or a clearer signal on interest rate cuts in the near future.

Gateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.