Daily Market Analysis and Forex News

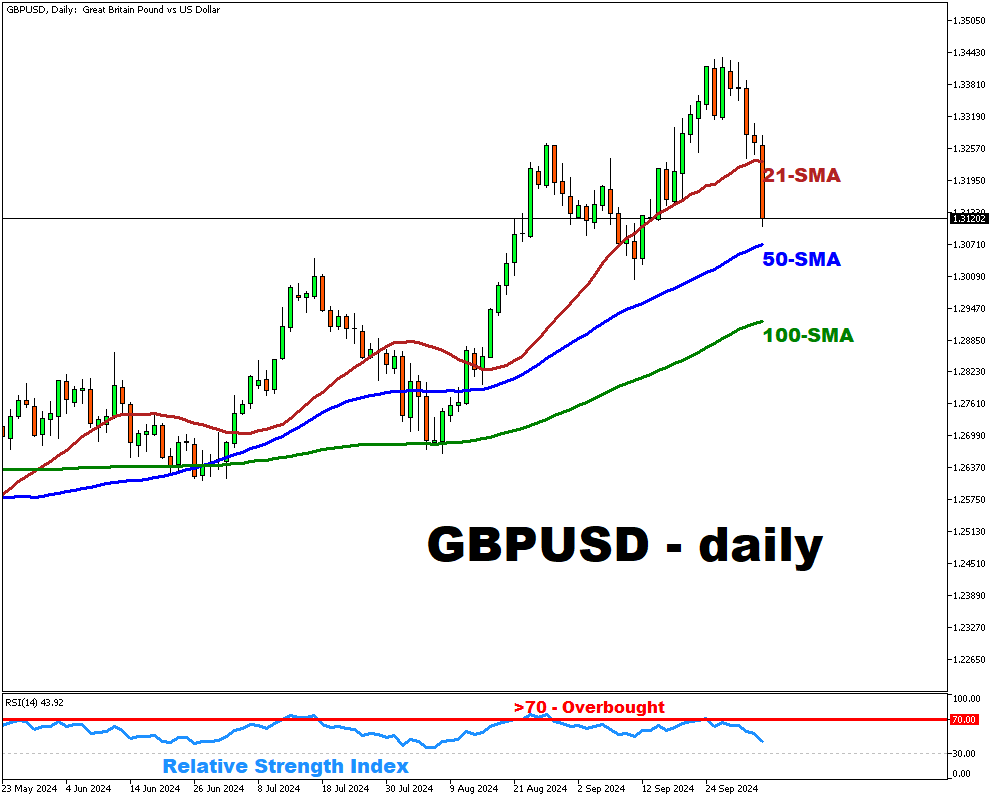

GBPUSD slides! Here’s what’s behind the fall!

- GBPUSD drops ~1.15% from late September highs

- BoE hints at faster interest rate cuts ahead

- 25 basis point cut expected in November

- Pound gained 1.9% in September

The British pound's value dropped 1.15% today, retreating from the highs it reached in late September, – the strongest levels since March 2022.

This decline came after the BoE Governor Andrew Bailey hinted in an interview that the central bank might accelerate its interest rate cuts if inflation continues to show positive signs.

As a result, market expectations are now leaning towards a 25 basis point rate reduction in November, with a 40% likelihood of a similar decrease in December.

The Bank of England had maintained interest rates at 5% in September, following a 0.25% cut in August.

Despite this, the pound has been gaining ground due to a broader decline in the US dollar, with investors anticipating a more rapid easing of monetary policy by the Federal Reserve compared to other major central banks, including the Bank of England.

In September, the pound has demonstrated a 1.9% growth.

Gateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.