Daily Market Analysis and Forex News

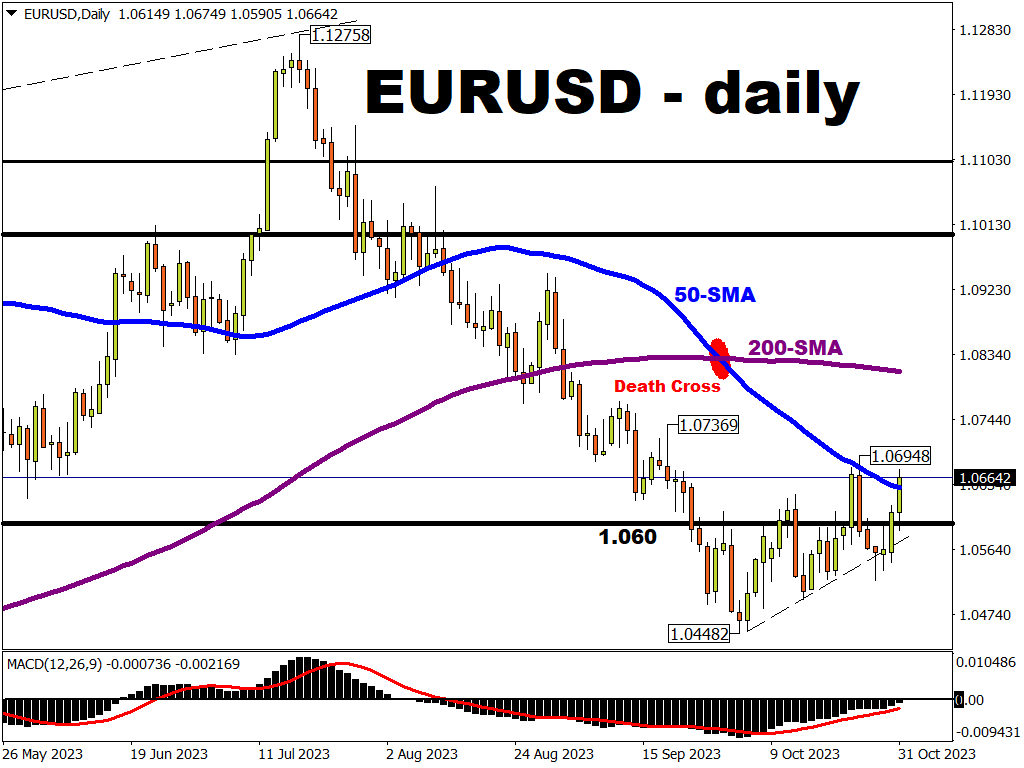

EURUSD breaches 50-day SMA despite economic contraction

The euro is strengthening against almost all of its G10 peers, except for the Swedish Krona (SEK).

EURUSD, the world’s most-traded FX pair is back above its 50-day simple moving average (SMA), with euro bulls eager to reclaim the 1.070 handle.

Such gains for the euro currency are intriguing, given that Euro-area October headline inflation was revealed to have touched a fresh two-year low of 2.9%.

Furthermore, the Eurozone economy shrank by 0.1% in 3Q compared to 2Q this year (quarter-on-quarter).

This shows that the European Central Bank’s aggressive rate hikes are having the intended effect of cooling inflation, while also serving as a drag on the economy.

With the Eurozone’s economic woes are laid bare, and markets already pricing in a one-in-three chance of an ECB rate cut occurring as soon as March 2024, such odds should limit the potential upside for EURUSD.

And to be fair, the 50-day SMA may yet kick in and exert stronger resistance over the course of the trading day.

How might EURUSD fare in November?

The Bloomberg FX model predicts a 71% chance that this FX pair will trade within the 1.0456 – 1.0886 range throughout November.

If this FX pair can extend October’s series of higher highs and higher lows into the new month, then EURUSD may be on a path towards testing its 200-day SMA for resistance.

However, a daily close below 1.058 may upend the October uptrend and heap more downward pressure on EURUSD, especially if its economic woes only grow starker.

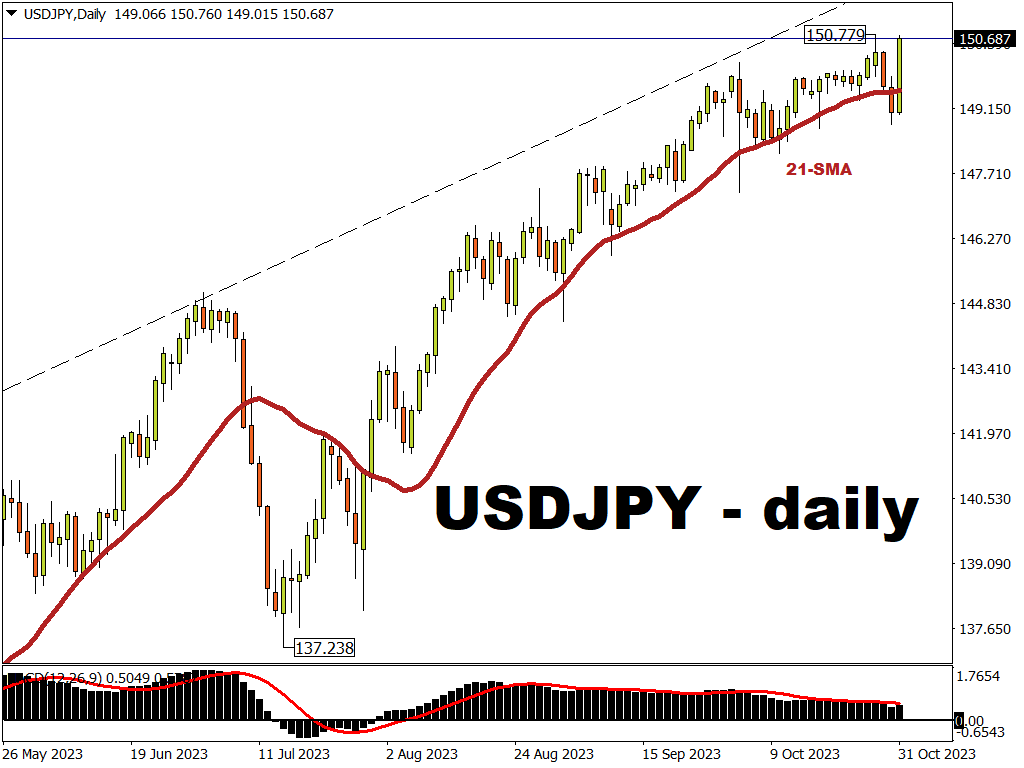

USDJPY flirts with fresh one-year high

The Yen has weakened against the US dollar, after the Bank of Japan (BoJ) disappointed markets earlier today.

Having recently found support at its 21-day SMA, USDJPY is now tantalisingly close to posting a fresh on-year high.

Leading up to today’s BoJ policy decision, markets had grown to expect a notable tightening of its policy settings.

Overnight, the Nikkei reported that the BoJ would consider adjusting its yield-curve control programme that prevents 10-year Japanese yields from going above 1%.

And to be fair, the BoJ did follow through, stating that the 1% mark is now a reference point and no longer a hard limit.

Yet, it wasn’t enough for Yen bulls.

Some segments of the markets had expected the central bank to be more forceful with its policy changes.

Instead, the BoJ stuck with its loose monetary policy settings and kept its Policy Balance Rate unchanged at negative 0.1%.

The net outcome from today’s BoJ decision cheered on Yen bears, who duly sent USDJPY back above the psychologically-important 150 line.

How might USDJPY fare in November?

For November, USDJPY is likeliest (78.6% probability) to trade within the 148.31 – 152.76 range.

Markets will be keeping a close watch over the prospects of another BoJ shocker, which it has a penchant for, at its next policy decision due December 19th.

Should markets once again dare to believe that the BoJ is taking steps towards a rate hike, that could reinvigorate Yen bulls and set USDJPY on a sustained downtrend.

READ MORE: Will USDJPY stay above or below 150 this week?

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.