Daily Market Analysis and Forex News

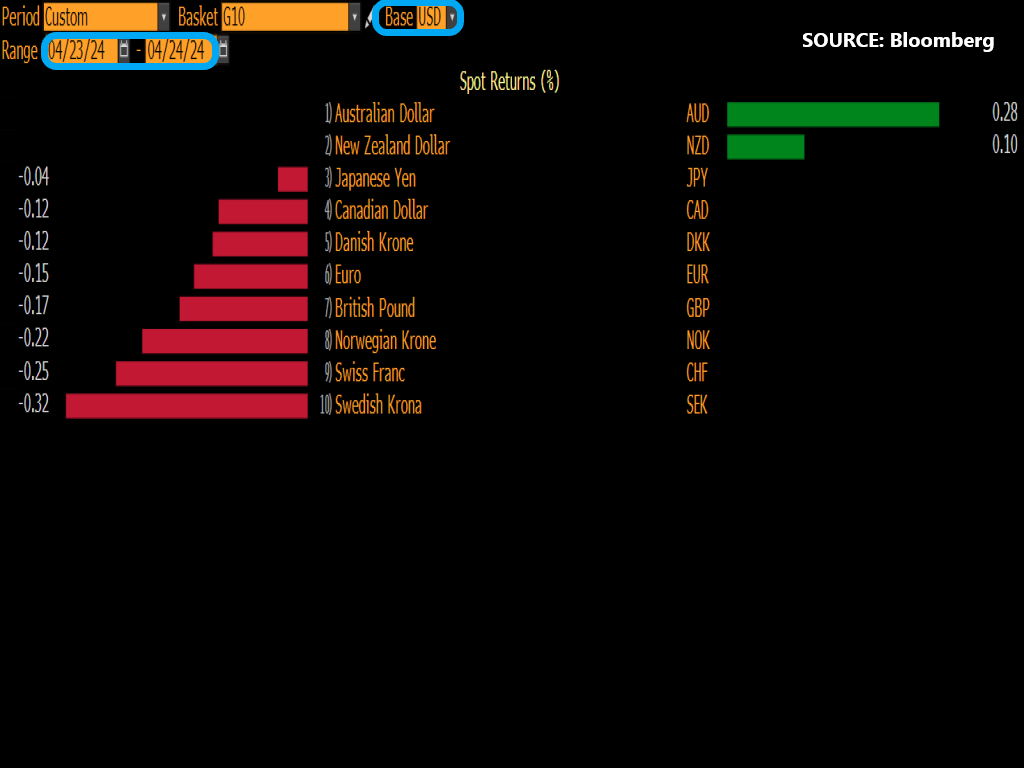

Here’s why AUD is today’s best-performing G10 currency.

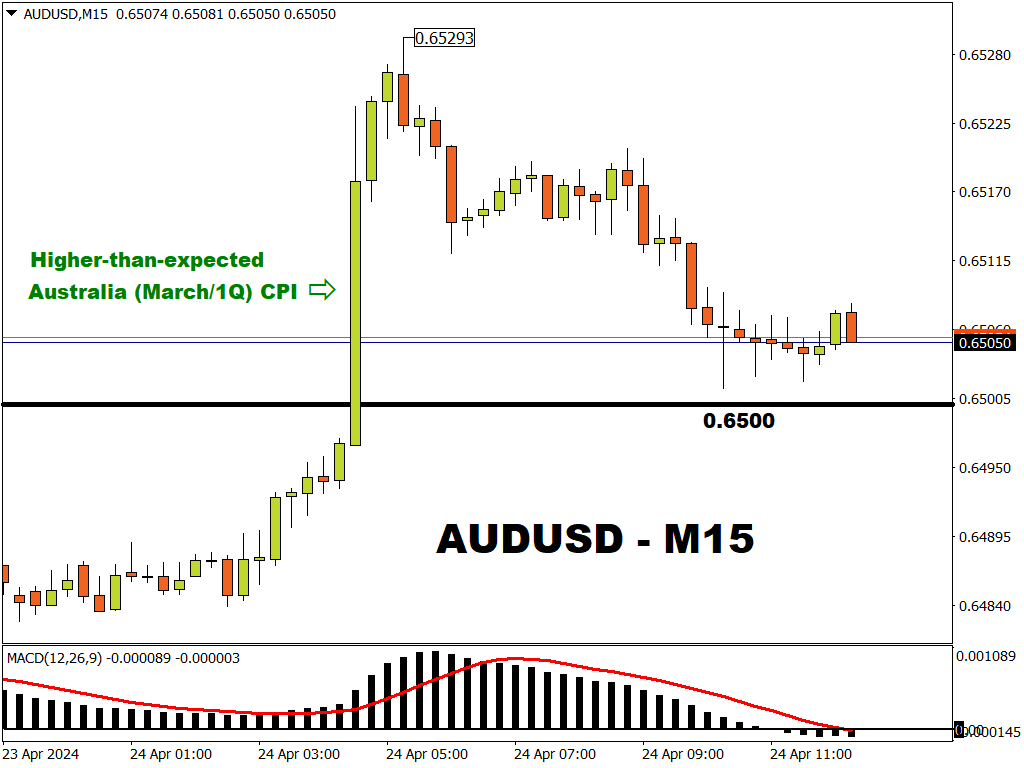

AUDUSD has climbed to its highest levels since April 12th.

The Aussie dollar spiked by over 300 points after Australia released higher-than-expected inflation numbers:

NOTE: The consumer price index (CPI) measures headline inflation

- March CPI year-on-year (March 2024 vs. March 2023): 3.5%

That 3.5% number is higher than the forecasted 3.4%

- 1Q CPI year-on-year (Q1 2024 vs. Q1 2023): 3.6%

That 3.6% number is higher than the forecasted 3.5%

- 1Q CPI quarter-on-quarter (Q1 2024 vs. Q4 2023): 1.0%

That 1.0% number is higher than the forecasted 0.8%

The faster-than-expected growth in Australia’s CPI suggests that the Reserve Bank of Australia (RBA), may be forced to keep its interest rates higher for longer.

This latest evidence of stickier inflation has even prompted markets to price in a 22% chance of an RBA rate HIKE in August this year!

That’s in stark contrast to the 95% chance of an RBA rate CUT by September 2024.

REMINDERS:

- The RBA is Australia’s central bank

- A major central bank typically uses higher interest rates to help cool down inflation

- The RBA hiked its Cash Rate Target by 425 basis points between May 2022 and November 2023.

- The RBA has since maintained its benchmark rate at a 12-year peak of 4.35%.

- Markets tend to push up the currency belonging to the economy that has higher interest rates.

Given all the above, no surprise that the Aussie is outperforming its G10 peers against the US dollar so far today (Wednesday, April 24th).

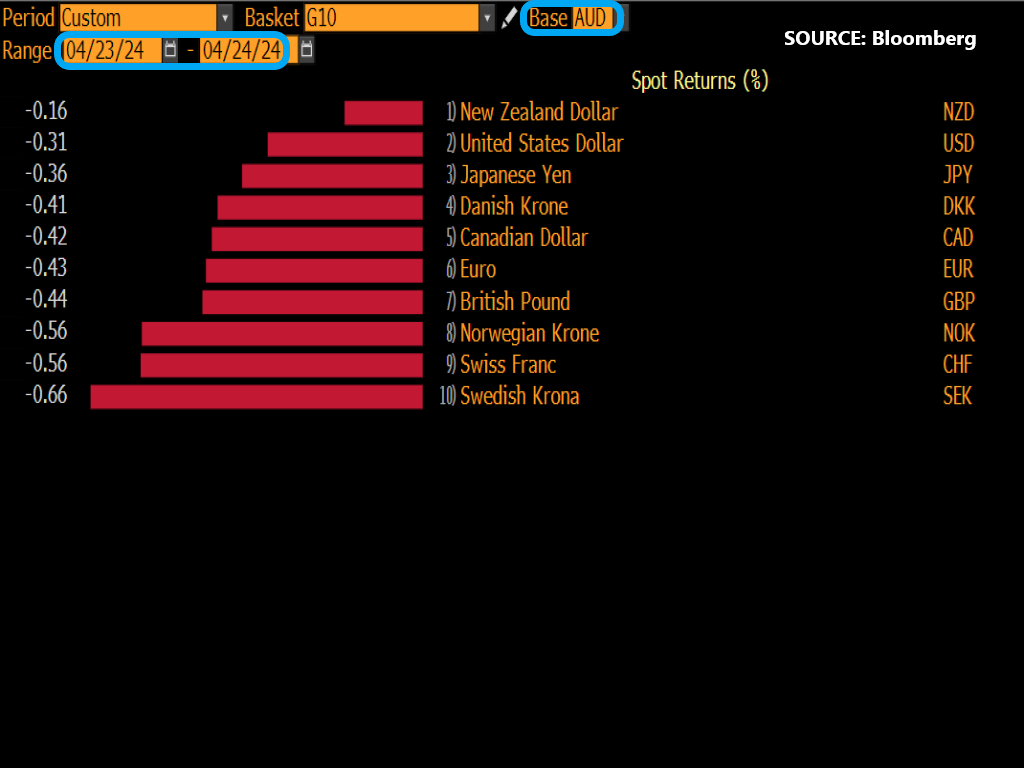

Furthermore, AUD is also stronger against all of its G10 peers today as well.

However, AUDUSD has since unwound much of its 300-point spike following the CPI surprise.

Zooming out to a longer timeframe, on the Daily charts, AUDUSD's spike was met by twin resistance

- 50-day simple moving average (SMA)

- 200-day counterpart.

Although this FX pair has now been restored back to the trading range it largely adhered to in Q1 2024 ...

Further gains for AUDUSD may prove a lot harder to come by.

Here are 2 major fundamental factors that are limited AUD's potential gains:

- China's economic fortunes are not recovering fast enough.

China is Australia's largest trading partner, hence the performances of these 2 economies are very much intertwined.

The AUD is often used as a G10 proxy to reflect China's economic performance.

In simpler words, a sluggish Chinese economy tends to limit the Australian Dollar's potential gains.

- Resilient US dollar

On the US dollar's side of the AUDUSD equation, inflation in the US has also proven sticky.

Hence, we find ourselves in a resilient US dollar environment, with the USDInd (US dollar index) rebounding to its highest levels since November 2023.

A resilient US dollar is set to prevent AUDUSD from pushing significantly higher from here.

Bloomberg's FX forecast model currently predicts a 73.6% chance that AUDUSD will trade between 0.6421 and 0.6586 over the next one-week period.

Market attentions are set to turn to the US-side of the equation in the days ahead:

- Thursday, April 25th: US 1Q GDP; initial weekly jobless claims

- Friday, April 26th: US March PCE Deflators (Federal Reserve's preferred gauge of inflation)

Further evidence of "US exceptionalism", which forces the Fed to keep US interest rates higher-for-longer, could further boost the US dollar and force AUDUSD to falter back below 0.6480.

"US exceptionalism" = when the US economy is faring better than its G10 peers

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.